Job-hopping may affect your mortgage options

Are you a job-hopper or a long-termer? In the past, floating from job to job used to be a black mark on a resume, as employers

Are you a job-hopper or a long-termer? In the past, floating from job to job used to be a black mark on a resume, as employers

What’s your plan for managing your finances this Christmas? “Gifts of time and love are surely the basic ingredients of a truly merry Christmas.” Peg

How to create a positive financial outlook to safeguard your family into the future is a common and regular conversation we have with our clients.

Have you ever stopped and thought about your retirement, and the lifestyle you’d like to achieve? How much KiwiSaver money would you need, on top

Ready to buy your first home? Purchasing property always requires a fair share of planning, especially when it comes to saving for your first deposit.

Is having your KiwiSaver in your online banking a benefit at all? Most of us have been told by the teller that a major benefit

The topic of house affordability is often in the news and if you believe everything you hear or read, you may think you’ll never be

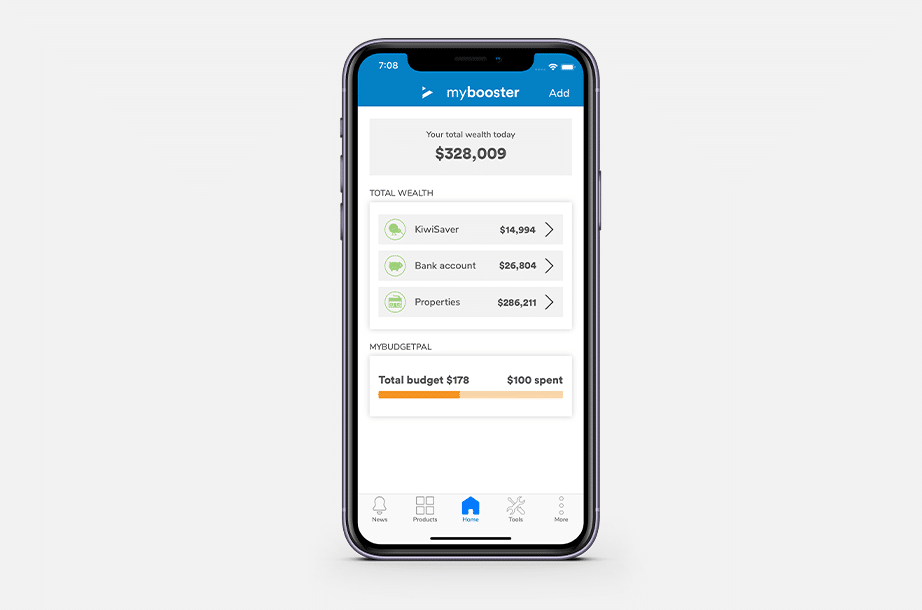

Imagine being able to monitor your total financial life from a single dashboard – including your KiwiSaver scheme, bank accounts, savings, debts, shares, property and

Spring is officially here and, as tradition goes, this season is the best time to sell a house. But how can you make sure your

Last month I talked about setting goals and what things could be included in your financial plan. Like a lot of things in life, taking

There has been increased interest recently from commercial property buyers, as more are seeing commercial as an attractive alternative to the residential market. Where buyers

Last month I urged you to ask yourself some questions: Where do I want to be in five years? What financial goals do I want

Copyright © 2022 Cole Murray. All Right Reserved. Supported by MRD Web + Digital Marketing