We hate to break it to you, but the answer is what you’ll hear from our Financial Advisers every time. It all depends on your situation. But let’s discuss …

We understand the appeal of getting your mortgage paid off quickly, but here’s the thing: your home, while a great asset, isn’t generating income while you live in it. Instead, it’s costing you money through insurance, rates, maintenance, and repairs. These costs never really stop, even after you’ve paid off the mortgage.

Investments work differently – they put money back in your pocket through dividends, rent, or capital growth you can access without selling your family home.

Owning your own home

Don’t get us wrong – buying your own home can be a smart financial move. Having a roof over your head without rent payments when you get to retirement is fantastic. Plus, the stability, the freedom to paint walls in your team colours if you want, and having somewhere your pets can call home too, are all great benefits.

How can you build your wealth

Investing can seem like a scary word, but it really doesn’t have to be. With the right support and advice, the benefits can set you up for the future you want.

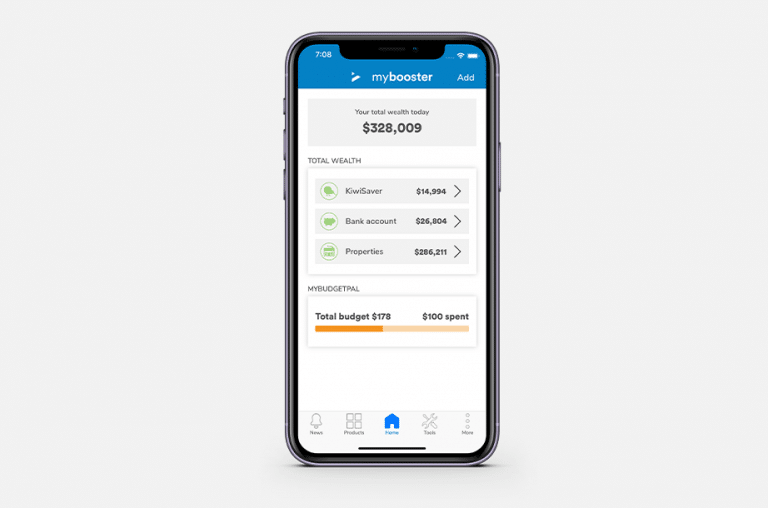

Optimising your KiwiSaver: If you’re not maximising your contributions, you’re leaving money on the table. Employer matching and government contributions are valuable financial incentives that boost your savings—without requiring any additional investment from you. Come and speak to one of our KiwiSaver Advisers if you are unsure if you are making the most of your KiwiSaver.

Investment property: If you have the capital and appetite for hands-on investing, rental property can provide you an asset as well as ongoing income streams. Our Mortgage Advisers are experts in this field. They help their clients invest in both commercial and residential property. Give them a call.

Investing in a managed fund: The investment world can seem overwhelming with so many different types of investments. Come and chat with one of our Wealth Advisers. They can see if creating an Investment Plan is right for you to get your savings growing.

Create a Financial Plan: A financial plan looks at your whole picture. You create short and long-term goals to help you plan for your future and achieve your financial goals. Give our Financial Advisers a call and they can see if a financial plan is right for you.

Come and chat with us

When you retire, you’ll need cash flow for daily living. Your paid-off home provides security, but it won’t pay for groceries or spoiling your grandchildren, repairing the leaking roof, or getaways around New Zealand and beyond. You’ll need investments that generate actual income.

We have a team of Financial Advisers who can look at your whole picture and work out the best solution for your situation.

Give us a call today.