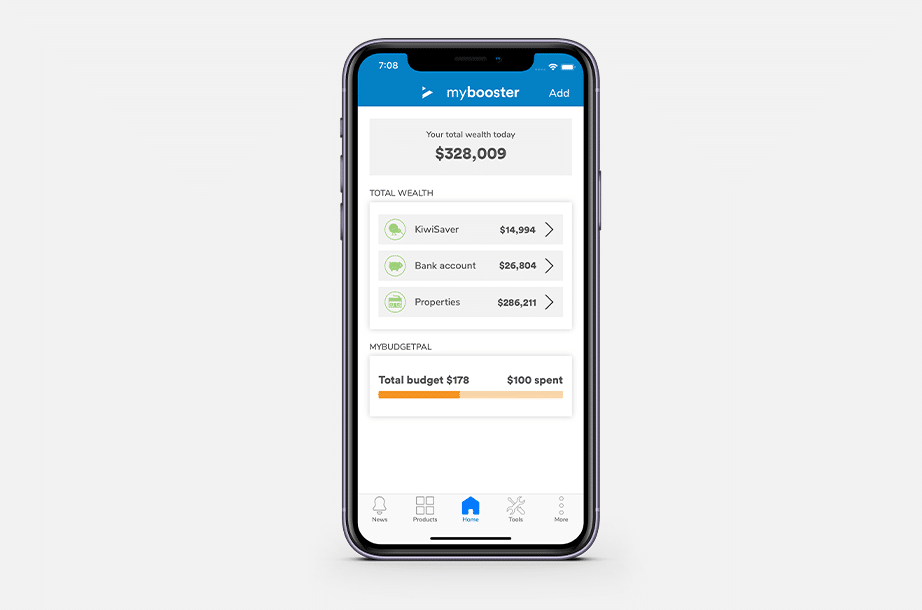

Imagine being able to monitor your total financial life from a single dashboard – including your KiwiSaver scheme, bank accounts, savings, debts, shares, property and other investments.

Booster NZ takes its customers’ relationship with money to a whole new level, enabling them to keep track of their finances in real time, and check how they’re performing. It’s safe to say, the Booster app provides a financial snapshot at Kiwis’ fingertips.

Staying on top of financial affairs is important, but it can also be time-consuming and hard to fit in our busy lives.

What does the app do?

Booster’s app allows its members to find out how their KiwiSaver account is doing, including the government contribution they’re entitled to. But it doesn’t end there. With a simple tap, you can get insight into your:

- Assets (savings, bank accounts, KiwiSaver, etc.)

- Debts (loans, mortgages, student loan, credit cards etc.)

- Total wealth – how much you own vs. how much you owe – to instantly give you an overview of how you are tracking

The app is clever enough to link in with all the major banks, so that you can get a snapshot of your bank account and loan balances in the one place.

Taking control of your total financial picture

Thinking and understanding your total financial picture is a key step to improving your future prospects and wellbeing. How long has it been since you’ve asked yourself:

- If you have a mortgage, how much do you currently owe the bank?

- What about your bank account?

- How much do you have invested in KiwiSaver or other investments?

The bottom line is, everyone can benefit from having a good level of control over their finances, and on this note, the Booster app does a great job of putting together relevant, up-to-the-minute information and bundling it all up in a unique, visually enticing and easy-to-use dashboard.

Is Booster your KiwiSaver or Investment Provider?

Download the app here for iOS or here for Android.

If you’re interested in learning more about managing your total financial picture, or if you’re considering Booster as a provider, talk to one of our experienced KiwiSaver Advisers today.

Booster online

You can also check your Booster KiwiSaver online at any time – and there’s lots of other neat things you can check too!

We recommend doing this once every few months (no more though – and here’s why), so that you can keep an eye on how your nest egg is growing over time. As it’s a long term investment it will be subject to the highs and lows of investing (more so if you’re in any high growth funds), but what you are looking for is steady growth over time.

It’s also a good idea to keep tabs to ensure that your employer is paying their part, as well as that the IRD is paying your government contribution each year (if you’ve qualified that year), and that your fund is performing in line with your expectations.

Here’s how to access your Booster KiwiSaver account online:

- Go to the Booster Login page.

- Click Login to Booster. If you haven’t registered yet, see details below on how to do this.

- Enter your member number and password (don’t worry you can ask for help if you’re not registered or have forgotten your password)

You can now view your account details online – easy!

Don’t know your Username?

That’s ok, we can help you! Just contact our KiwiSaver advisers and we’ll look it up for you.

Not registered for Online Access?

That’s ok, registration is nice and easy. Here’s how:

Note: You’ll want to complete your registration within 24 hours, otherwise you will need to start the online sign-up process again.

- Go to the Booster Login page.

- Click on Register with Booster.

- Enter your email address and member number (if you’ve changed your email address lately or don’t know your member number you may need to contact us to assist). Click on the Submit button.

- A confirmation email will be sent to the email address Booster have on file for you.

- Click on the link in the email, then enter your member number and IRD number.

- You’ll then need to choose and confirm a password.

You are now registered to access your member account online.

When you log on you can:

- view all contributions received from you, your employer and the Government

- see which Funds your money is invested into

- see the value of units you hold

- find out what fees and taxes you are charged

- view and change your Prescribed Investor Rate

- view and change your contact details

- view your overall account balance

- view your government contribution indicative entitlement

- view your retirement date

Booster’s transactional history function allows you to easily reconcile all your contributions without needing to also use IRD’s online service, provided all your contributions have been passed onto the Scheme. Remember though that it can take up to three months for the money to pass from your employer through the IRD and into your KiwiSaver account.

Got more questions?

Get in touch with us today and we can show you the ropes of your online account, and answer any questions you may have.

Email our KiwiSaver advisers now or phone 06 870 7050.